The Latest Cathedral News

Book Group Tuesday, March 3 at 6:30 p.m.

February 09, 2026

The St. James Book Group will meet on Tuesday, March 3 at 6:30 p.m. in Room 210 at 65 E. Huron. The book for March's meeting is “Tender is the Night” by F. Scott Fitzgerald. If you have questions, please contact Marcy.

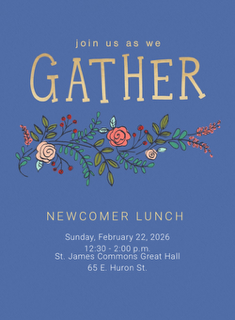

Newcomer Lunch Sunday, February 22, 12:30 p.m.

February 04, 2026

If you are new or "newish", you are cordially invited to join other newcomers as well as people who have been around for a while for lunch and conversation on Sunday, February 22 from 12:30 until 2:00 p.m. Look for your Evite invitation if you’ve submitted a Welcome Card, or email Laura Jenkins to let her know you'll attend. In your RSVP, please indicate if you have any dietary restrictions and if you will need childcare during the event.

First Sundays Book Group, March 1 at 1 p.m. in Room 212

January 28, 2026

What does it mean to live a good life, especially in painful times? How do we persevere through suffering, not in denial or despair, but grounded in abiding hope? What does it look like to love not only our neighbors but even our enemies? Many thoughtful Christians have wrestled with these perrenial questions and offered reflections to help us do the same. Join us on the first Sunday of each month for a discussion inspired by one of their works. Our first book will be When the World Breaks by Jason Adam Miller. PS – feel free to bring your lunch. Contact Kim Moreland (1stSundays@saintjamescathedral.org).